The Paris Agreement, established during the COP21 meeting in 2015, set the target to keep the global average temperature increase to “well below 2°C above pre-industrial levels; however, 9 years later, progress has been slow, and many scientists openly question the ability of countries like the UK to keep to their commitments.

With an election looming, UK political parties are touting their “Green” credentials, but none have yet issued statements on how they will correct the current, complete policy mess.

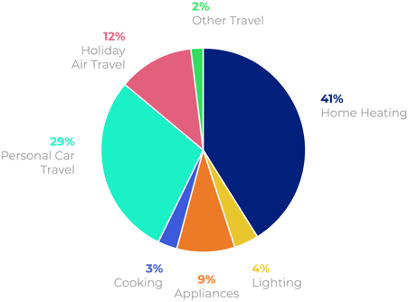

The above table shows the mix of emissions for an average UK citizen. The three largest sectors—home heating, car ownership, and travel—all need simple, clear policies that remove the current illogicality below.

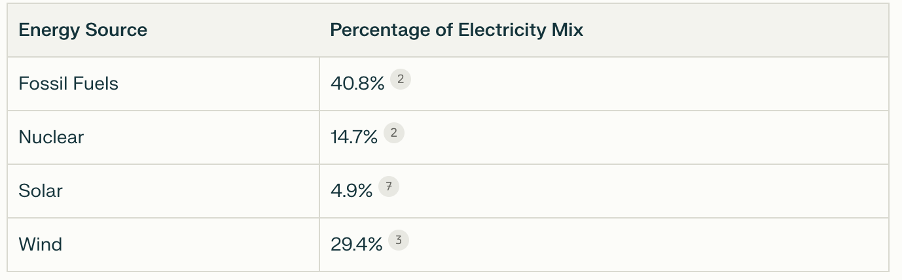

Clean up UK Energy production.

There is no point in switching to electric cars or heating unless the Government rapidly cleans up electricity production. The most cost-effective route to do so is a large expansion of nuclear power via the regeneration of old generators and the introduction of Rolls Royce “Micro” power stations located within the grounds of secure locations such as Airports.

Fund Carbon Extraction projects.

Installing carbon capture technology to remove carbon from gas-powered electricity production or heavy manufacturing is the quickest and most cost-effective route to reducing emissions. However, the Government has yet to confirm funding for numerous projects that have been identified for over five years.

This is a complete scandal and needs the next Government to take a long-term view of funding.

Chang EPC Rating calculations

Heating our homes with Gas boilers is our largest single contribution to global warming. However, on average, replacing these heaters with electric versions increases the cost by 63%, which few UK residents want to pay during the current energy crisis.

Logically, the government has banned the installation of gas heating in all new builds since 2025, pushing for the installation of efficient new electric heating systems, which become cost-neutral when combined with extra insulation.

However, stupidly, it has not updated how EPC ratings are calculated, meaning that if landlords replace Gas Heaters with electric ones, their EPC ratings automatically drop a band, which could quickly lower them below the minimum E level required to allow them to be rented. This is because the EPC ratings are more heavily weighted around the cost of heating, and they have not been updated to take into account of new, more efficient electric heating systems.

This is pure stupidity and, of course, will put most landlords off replacing polluting Gas Boilers.

Powering the Electric Car Revolution.

Unplugging the petrol pump and replacing it with electricity offers EV owners a 45% cut in car running costs, and at 29% of our personal emissions, it is the simplest thing any of us can do to save the planet, particularly for the 52% of us who can install chargers are home. However, currently, EVs carry a 20% price premium over their petrol equivalents, requiring Government subsidies to encourage adoption. However, again, the Government’s current policies lack common sense or simplicity.

EV Salary Sacrifice Schemes.

The Government has been incredibly lazy in introducing tax breaks to encourage the move to EVs.

They have stumbled into using existing Salary Sacrifice Scheme tax breaks, designed to encourage cycle-to-work and nursey use, to promote the switch to EVs. The scheme is ridiculously generous, offering savings of 28-42% off EV Leases, and it is inequitable because the more you earn or, the more expensive the EV, the more you save.

The biggest issue with this scheme, however, is that it is only available if your business is willing to use its balance sheet to lease the vehicle on behalf of an employee. It cannot be used by the 80% of UK residents who want to buy or rent an EV in their own names.

Offer Tax credits on Second-hand EV

The purchase of new EVs provides the Government with its highest single VAT earning, with a £60k new EV bringing in £12k of VAT revenue.

This tax revenue should be allocated to provide a £7k tax credit for first-time converts from petrol to EVs, moving up the threshold hold tax that tax is paid from £12k to £19k. This would provide the same 32% tax saving of £2,240 to all taxpayers equally, with each new EV sale funding 3 second-hand subsidies.

The same DVLA information used to operate “Scrappage” schemes could be used to police the tax breaks and make sure they only go to people giving up I.C.E car benefits. Ideally, after 4 years, the second-hand EV would attract another £2,240 grant, making the EV more attractive for I.C.E car owners to cover the older it gets. This would make EVs affordable to the least affluent, who would benefit from their 50% lower running cost compared to older and more polluting I.C.E cars. This would quickly push the electrification of cars into all layers of society.

Scape “Air Passenger Duty” and introduce a “Carbon Offset Charge” on all Flights.

Air Travel, by its nature, will always be polluting, but holidays are essential to mental health and provide families with a relaxing time to spend together.

If the UK Travel industry is not careful, however, younger generations are likely to treat it like the “Tobacco” industry, shunning it because of its environmental impact.

The easiest way to prevent this is to escape the “ambiguous” APD tax that disappears into the government coffers without any explanation of what it is used for and replace it with a Carbon offsetting Tax that is used specifically to fund much-needed Carbon Extraction projects. This tax must be compulsory on all flights and can be used to reassure customers that their travel emissions are being offset, allowing guilt-free travel.